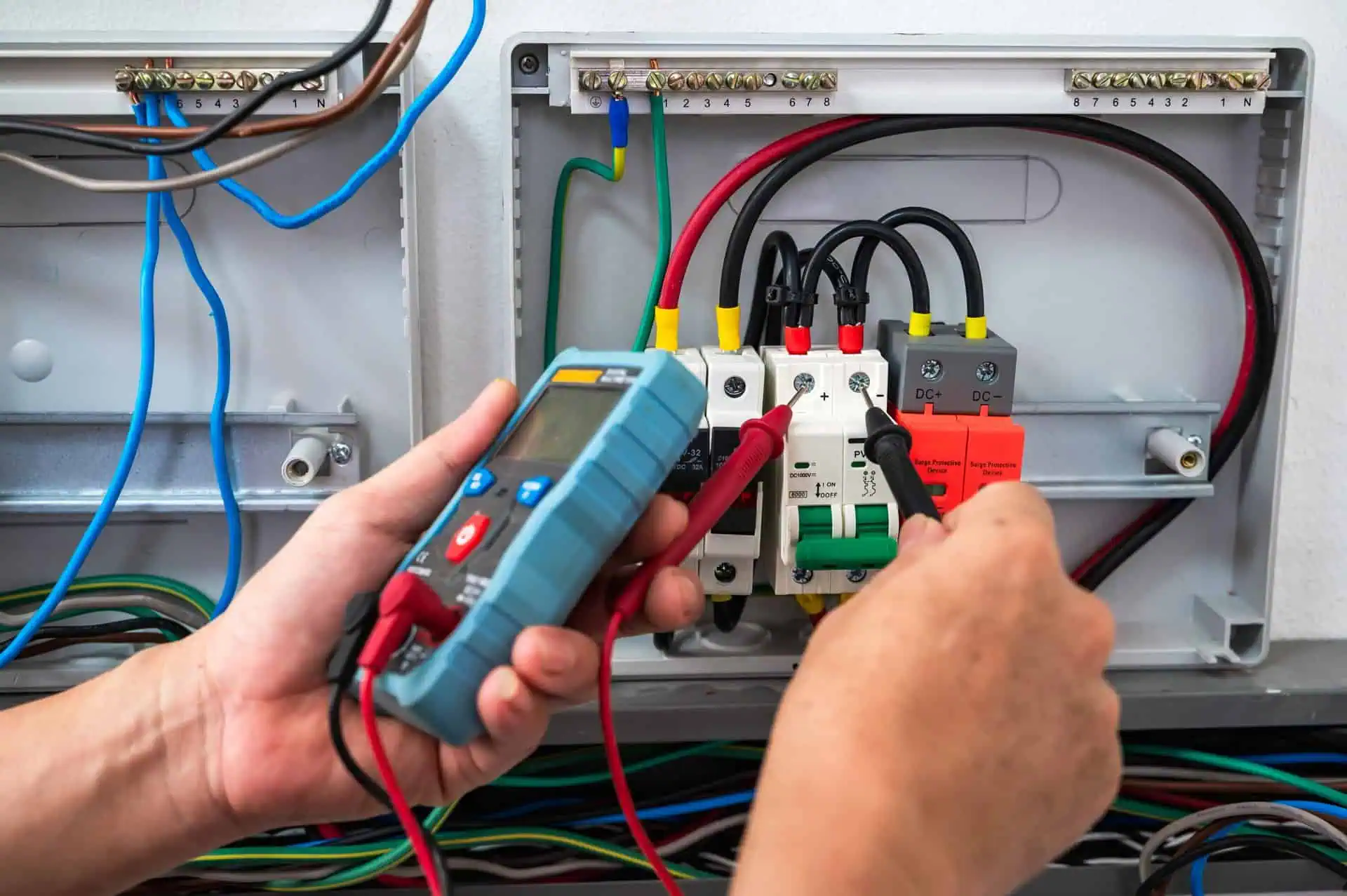

Electricians face unique risks every day, from working with live wires to handling complex electrical systems in homes and commercial buildings. Whether you’re a self-employed contractor or manage a small team, having the right electrician insurance in Massachusetts can help protect your business from the unexpected.

At Coonan Insurance Agency, we understand the local challenges electricians face and help you find coverage that fits your needs and budget.

What Is Electrician Insurance and Why Is It Important in Massachusetts?

Electrician insurance is a collection of business insurance coverages designed to help protect electricians from various risks associated with their trade. In Massachusetts, electricians often work on residential, commercial, and industrial sites where accidents, property damage, or injuries can occur.

Having electrician insurance can provide financial protection if a client, employee, or third party files a claim related to your work. For example, if a wiring installation causes property damage or someone gets hurt on a job site, your policy could respond to help with associated costs.

Beyond financial protection, insurance can also help Massachusetts electricians meet local licensing and client contract requirements. Many general contractors and municipalities require proof of insurance before electricians can start work, making it an essential part of doing business in the state.

What Types of Insurance Coverage Should Electricians Consider?

There is no one-size-fits-all policy for electricians. The right mix of coverage depends on the size of your business, the services you provide, and where you operate. Here are several common types of coverage Massachusetts electricians may want to explore:

- General Liability Insurance – This coverage helps protect your business if a third party claims property damage or bodily injury caused by your work. For example, if a client’s equipment is damaged during an installation, this coverage may help cover related costs.

- Commercial Property Insurance – If you own a building, office, or valuable tools, commercial property insurance can help protect those assets in the event of covered losses such as fire, theft, or vandalism.

- Business Owners Policy (BOP) – A BOP combines general liability and property insurance into one policy and may include additional coverage options. This can be a convenient and often cost-effective choice for many small electrical contractors in Massachusetts.

- Workers’ Compensation Insurance – Massachusetts law generally requires employers to carry workers’ compensation insurance for their employees. This coverage can help with medical costs and lost wages if an employee gets injured or becomes ill due to work-related activities.

- Commercial Auto Insurance – If you use vans or trucks to transport tools and equipment to job sites, commercial auto insurance can help protect your business vehicles in the event of an accident, theft, or other covered incident.

- Professional Liability Insurance – Sometimes referred to as errors and omissions insurance, this coverage can help if a client claims that your professional advice or electrical design caused them a financial loss.

- Tools and Equipment Coverage – Electricians depend on specialized tools and equipment every day. This coverage can help if your tools are stolen or damaged while on a job site or in transit.

How Does Electrician Insurance Help with Client Contracts and Licensing?

In Massachusetts, most electricians must be licensed through the Board of State Examiners of Electricians. To obtain and maintain licensure, proof of certain types of insurance—such as workers’ compensation—is typically required.

In addition, many commercial clients and general contractors require proof of liability insurance before awarding contracts. By maintaining proper electrician insurance, you demonstrate professionalism and responsibility, which can help you secure larger projects and build client trust.

Having certificates of insurance on hand also streamlines contract negotiations. It shows you have considered potential risks and taken steps to help protect your clients and your business from costly claims.

How Much Does Electrician Insurance Cost in Massachusetts?

The cost of electrician insurance in Massachusetts can vary depending on several factors, including:

- Business size and annual revenue

- Number of employees

- Location and type of work performed

- Claims history

- Coverage limits and deductibles

A small, self-employed electrician may pay less than a larger company with multiple employees and vehicles. The best way to find accurate pricing is to work with an experienced local agent like Coonan Insurance Agency, who can compare quotes from multiple carriers and tailor coverage to your business needs.

What Risks Do Electricians Commonly Face on the Job?

Electricians encounter a variety of workplace hazards, including:

- Electrical shocks and burns

- Falls from ladders or scaffolding

- Property damage during installations or repairs

- Tool and equipment theft

- Vehicle accidents during service calls

Even the most careful professionals can experience accidents or claims. Electrician insurance provides a safety net to help manage these risks and support the long-term stability of your business.

How Can Electricians Improve Job Site Safety to Reduce Insurance Risks?

While insurance offers financial protection, maintaining strong safety practices can help reduce the likelihood of claims. Some effective strategies include:

- Conducting regular safety training for all employees

- Using proper personal protective equipment (PPE)

- Inspecting tools and wiring before each job

- Keeping detailed maintenance and job site records

- Following all Massachusetts electrical codes and OSHA regulations

A proactive approach to safety not only helps protect your team but can also make your business more attractive to insurers.

Why Work with a Local Massachusetts Insurance Agency?

Working with a local agency like Coonan Insurance Agency means you get personal service from professionals who understand the Massachusetts market and local regulations. Our team can help identify coverage gaps, compare policies, and ensure your electrician insurance aligns with your business goals.

We take the time to learn about your operations, tools, and unique exposures so we can recommend coverage options that fit your situation. Whether you’re a solo electrician or manage a team, our goal is to help you protect what you’ve built with confidence and clarity.

How Can You Get a Quote for Electrician Insurance?

Electricians power Massachusetts homes and businesses, and they deserve insurance coverage that supports their work and growth. With Coonan Insurance Agency, you get the benefit of local expertise and personalized service. Contact us today to learn more about electrician insurance and how we can help protect your business for years to come.