We offer Equipment Breakdown Insurance coverage in Massachusetts, Maine, New Hampshire, Rhode Island, Maine, New York and Florida.

Please ask one of our agents how we can provide you with insurance across multiple states.

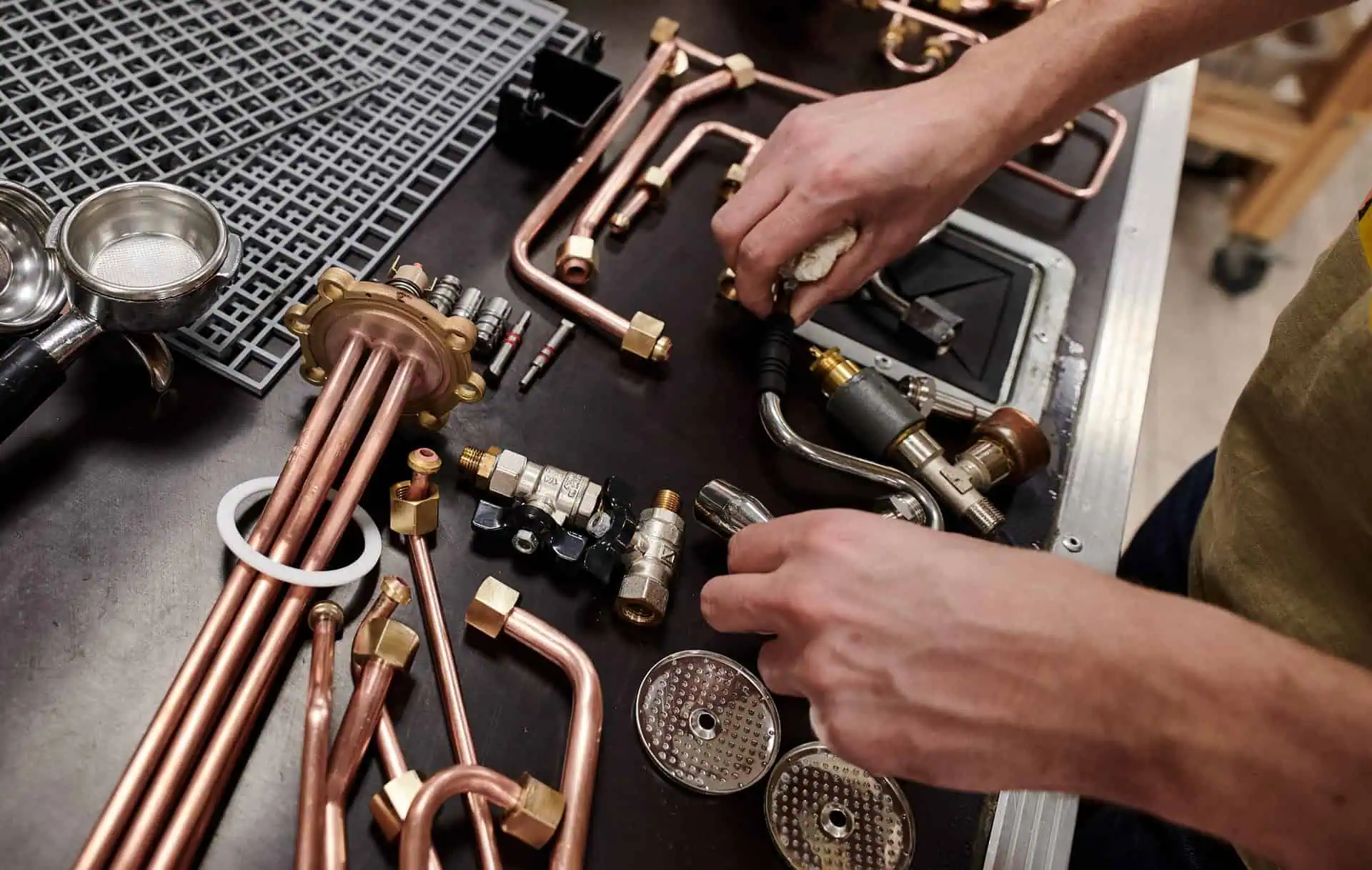

When essential systems stop working, your business can come to a standstill. From heating systems to electrical panels and point-of-sale equipment, the failure of modern machinery can cause unexpected disruption. Coonan Insurance Agency helps Massachusetts businesses prepare for the unexpected with Equipment Breakdown Insurance designed to support continued operations.

What is Equipment Breakdown Insurance?

Equipment Breakdown Insurance helps provide protection for a variety of mechanical, electrical, and pressure systems when they unexpectedly stop working due to internal failure. While commercial property insurance often covers external events like fires or storms, it typically does not cover breakdowns from internal sources like power surges or motor burnout. Equipment Breakdown Insurance can fill this gap and help reduce the financial impact of sudden mechanical failures.

In a state like Massachusetts, where changing weather patterns and seasonal shifts put additional strain on HVAC systems and refrigeration units, this type of coverage may be an important part of your insurance portfolio.

Why Might Your Massachusetts Business Consider Equipment Breakdown Insurance?

Even with regular maintenance, modern equipment can still malfunction. Businesses across Massachusetts, from local restaurants in Worcester to small manufacturers in Springfield, rely on a range of systems and machines to operate efficiently. Equipment Breakdown Insurance can help provide coverage for repair costs, lost income, or replacement expenses related to certain types of mechanical or electrical failures.

For example, a small bakery in Boston might depend on commercial ovens and refrigeration units. If a surge causes these appliances to fail, Equipment Breakdown Insurance may help cover the repair or replacement costs as well as any income lost during downtime.

Quotes Available in MA, RI, CT, NH, ME, NY and FL

What Types of Equipment Are Typically Covered?

Policies may vary, but Equipment Breakdown Insurance can typically apply to a broad range of equipment and systems that are critical to business operations. This may include:

If your Massachusetts business relies on machines to keep things running, this type of insurance may be worth considering as part of a broader risk management plan.

How Does This Coverage Differ From A Standard Property Policy?

Commercial property insurance is designed to help cover damage from external events like fire, theft, or storms. However, it often excludes losses from internal equipment failures. Equipment Breakdown Insurance is intended to help fill that coverage gap by addressing sudden and accidental breakdowns from causes such as short circuits, operator error, or motor burnout.

For example, if a surge damages your electrical system, your property policy may not cover the resulting repair costs. Equipment Breakdown Insurance could help in situations like these, depending on the terms and conditions of your specific policy.

Who Might Benefit Most From This Insurance In Massachusetts?

Businesses of all sizes across Massachusetts may benefit from this type of coverage, especially those that rely heavily on equipment or technology. Industries that often consider this insurance include:

- Food and beverage businesses

- Healthcare providers

- Office-based operations with critical IT systems

- Retailers with point-of-sale machines and refrigeration units

- Light manufacturers and workshops

Massachusetts experiences a wide range of weather conditions throughout the year, which can increase stress on mechanical systems. Businesses that can’t afford extended downtime due to equipment failure may want to explore this type of insurance option.

What Are Some Common Scenarios Where Equipment Breakdown Insurance May Help?

Breakdowns rarely happen at convenient times, and the resulting interruptions can quickly become costly. Here are a few scenarios where Equipment Breakdown Insurance may provide support:

- A transformer fails during a summer heatwave, causing your central air system to stop functioning and forcing your office to close for several days.

- An electrical short damages the refrigeration system in your Cambridge café, spoiling your inventory and requiring emergency repair services.

- A key piece of manufacturing equipment in your Lowell facility seizes due to internal mechanical failure, halting production until parts arrive.

In each of these situations, the right Equipment Breakdown Insurance policy may help manage repair costs and income loss.

How Can Coonan Insurance Agency Help Your Business?

At Coonan Insurance Agency, we work with businesses across Massachusetts to understand their operations and offer insurance options that make sense for their specific needs. Our experienced agents take time to review your current coverage, assess potential equipment risks, and present solutions that align with your business goals.

Whether you’re a new startup in Worcester or a long-established business in the Greater Boston area, we offer personalized guidance and ongoing support. We’ll help you navigate policy details and answer any questions so you can make informed decisions about your insurance coverage.

Why Choose a Local Massachusetts Insurance Agency?

Working with a local agency like Coonan Insurance means partnering with professionals who understand the unique challenges faced by Massachusetts businesses. From New England winters to power grid issues and local building codes, our team is familiar with the factors that influence business operations here.

We are proud to serve our community with transparency, responsiveness, and an emphasis on building lasting relationships. Our goal is to provide you with the information and support you need to feel confident in your insurance strategy.

Ready To Explore Your Options?

Unexpected breakdowns don’t have to stop your business in its tracks. Equipment Breakdown Insurance may be a smart addition to your risk management plan. Coonan Insurance Agency is here to help you explore your coverage options and find solutions that fit your budget and operations.

Contact us today to schedule a consultation or request a quote. We’ll walk you through the process and help you protect what matters most: your ability to keep your business running smoothly.